The market for electric car charging is characterized by low profitability due to large start-up investments, a complicated system of actors and poor user experiences.

The charging market for electric cars is growing rapidly and include many interesting business models, which hopefully can help drive the market in a more profitable and user-friendly direction, according to a recent TØI report. The study has reviewed the Norwegian charging system for electric cars.

The electric car market in Norway and the surrounding ecosystem have experienced formidable growth over the past decade. But the market for electric car charging – apart from home charging – is characterized by low profitability due to large start-up investments, a complicated picture of players and far too many bad user experiences.

A complex and little user-friendly charging market

The study examines how the market for electric car charging consists of a number of different business models in different parts of the value chain, which results in a complex system that does not consistently deliver top quality to end users. There is great uncertainty about which business models are best suited for public charging stations, partly because the utilization rate is still consistently low and the roles of the public and private sectors are not well defined.

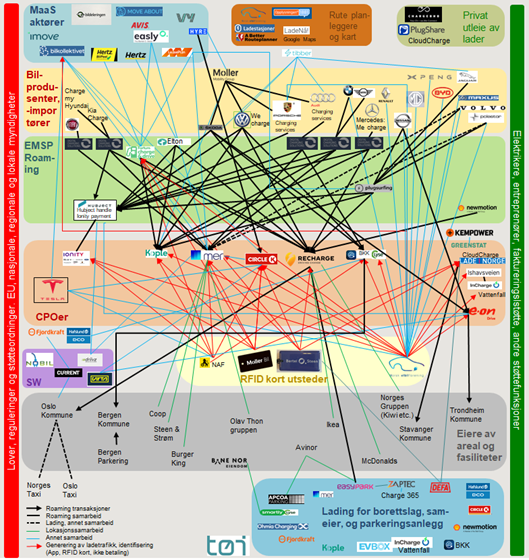

By reviewing the most central market players in Norway, the researchers find a complex picture of how the charging system works and how the players interact.

The main groups of market players consist of charging station developers and operators, so-called CPOs, service providers who connect customers to CPOs (E-Mobility Service Providers – EMSPs), land area and facility owners, car manufacturers and importers, mobility players, map services, energy sector players, developers of charging systems in housing associations and condominiums, person to person – charging facilitators, and suppliers of hardware and software. In addition, the market is affected by laws, regulations and support schemes as well as a number of players who supply services related to development, operation and maintenance of chargers (e.g. electricians, contractors and other support functions).

The figure above illustrates the most important players and how they interact with each other, either through financial transactions, generating traffic on the chargers or other types of collaboration. The result is an intricate and unstandardized charging market. All the players follow their own business models, which individually may make sense based on the player’s role in the value chain, but the overall charging market becomes dysfunctional for users when 20-30 apps are needed to access all available charging options, and when 13 different payment solutions are in use, but not credit card payment. This comes on top of an already complex charging system with different plug types, power levels and user interfaces on the chargers themselves.

The overall charging market becomes dysfunctional for users when you need 20-30 apps to access all charging options, and when 13 different payment solutions are in use, but not credit card payment.

Large turnkey suppliers and car manufacturers as central charging players

The ecosystem for electric car charging is developing rapidly and there is great uncertainty about what the situation will look like in a few years. The report discusses various possible scenarios.

Market consolidation to large total suppliers (large integrated CPOs and EMSPs), and/or the car manufacturers entering as more central players in the charging market itself, is most likely. However, one must be aware of a potential snowball effect if an increasing number of actors offer e-roaming, i.e. the possibility to charge across multiple actors with internal invoicing and where customers receive a consolidated invoice from their main supplier.

Better customer experiences can also be achieved through interaction platforms that create a virtual overview of available chargers from various suppliers and enable charging possibility at all available platforms. If the market itself is unable to establish an overall acceptable customer experience soon, an increased element of government regulation may become necessary.

The authorities should monitor developments

The charging market is expanding constantly and there need to be valid reasons to interfere and disrupt the ongoing competition and innovation with new, specific regulation.

But the Norwegian Competition Authority should pay attention to developments in the case of consolidation in the market, especially combined with vertical integration where the large CPOs also have an integrated EMSP service and intervene if some players end up abusing a dominant position, both vis-à-vis competitors and customers.

In certain aspects, it may also be reasonable to establish more authority requirements, as long as the public sector through municipalities, county councils or ENOVA supports investments in charging infrastructure or is the owner itself. They are entitled to make demands on or emphasize solutions that provide the best possible charging accessibility, and which shape electric car owners’ expectations of increased accessibility, e.g. by enabling e-roaming and by sending real-time information to NOBIL (Norway’s common database for charging infrastructure). As a minimum, all EMSPs must have access to data about the status of chargers in order to provide good services. This can help stimulate the market in a more user-friendly direction.

The report is part of the project “Spot-On – User-Centric Charging Services for Electric Vehicles” which is led by Powerzeek and financed by the Research Council of Norway.

Text: Hanne Sparre-Enger, chief communication coordinator TØI.

Read more:

Paal Brevik Wangsness & Erik Figenbaum (2022): The Charging market – Complex and dysfunctional or future-oriented?: How does it actually function? (Summary in English).

Contacts

Erik Figenbaum

efi@toi.no

TØI Institute of Transport Economics, Norway

Paal Brevik Wangsness

pbw@toi.no

TØI Institute of Transport Economics, Norway

Follow us: